Table of Contents

What Is Inflation? Dick Clark Explains Purchasing Power

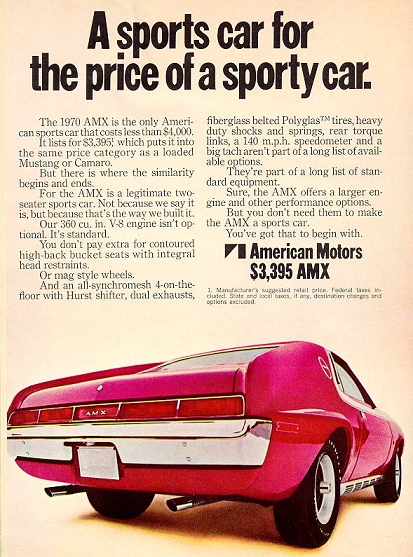

In 1973, the popular game show The $10,000 Pyramid debuted with host Dick Clark. It was a hit and soon rivaled Jeopardy! in popularity. Even after taxes, winning contestants could leave the studio with their prize money, go straight to the car dealership, and buy a sports car for $3,400. If one of Dick’s contestants didn’t understand how inflation worked, they might be peeved knowing that today’s remake of the hit show, now hosted by Michael Strahan, dishes out $100,000 in cash prizes to winners. “I could’ve bought ten sports cars with that money – or even a new house!” they might say.

Of course, we all know it doesn’t work that way. If you go to any car dealership today and ask for a brand new sports car for $3,400, chances are they’ll tell you to get lost, with maybe a few extra words included to really get their point across. We’d have to tell our friend the truth that, in reality, the $10,000 they won in 1973 is quite comparable to the check Michael Strahan is writing to winners today, and if they wanted to trade in their old car for a sportier modern version, they’d probably have to win The Pyramid again.

This is a great example of inflation in action. Over time, the value of our currency fluctuates. When it declines, the number of products and services we can buy with it decreases, and we’ll need more money to continue our old spending habits. This true value of a dollar is referred to as purchasing power. When prices go up, the purchasing power of our money decreases – and the speed at which this occurs is considered inflation.

Inflation in the News – Causes and Concerns

Inflation has been in the news a lot recently, and rightfully so – inflation recently had its largest annual spike since December 1981 with very little sign of stopping. During the first year of the pandemic, preventing a recession was the chief concern of the Fed. Now that inflation is accelerating, the Fed is putting the brakes on the economy. After understanding how inflation works, the next question is: How did we get here? There are multiple explanations:

- Damaged supply chain from COVID-19 and lockdowns – enforced largescale lockdowns disrupted the entire global supply chain. Border closures and employee shortages impacted everything from manufacturing to distribution, which in turn raised prices.

- Stimulus packages and low interest rates – the government distributed stimulus packages alongside significant interest rate reductions to prevent a recession. The result was more investment and spending that coincided with a damaged supply chain that was never repaired.

- Global energy shortages and price explosion – the economic coup de grâce was Russia invading Ukraine – leading to massive energy shortages and skyrocketing fuel prices, further exacerbating supply chain issues and uncertainty for economies worldwide.

So, a frozen global supply chain lowered supply and increased costs for businesses, which passed those costs onto consumers. Consumers could temporarily withstand higher prices because of a low interest rate and stimulus packages from the government. This helped prevent a recession, but the ultimate downfall was that the pandemic and poor market conditions lasted much longer than anticipated. Then, the straw that broke the economy’s proverbial back was Russia’s invasion of Ukraine, bringing us to where we are today. Now that we understand how we got here, the next step is uncovering how it will affect your merchant account. Inflation is an important cog in our economy. It can change how merchants do business in more ways than higher prices and supply shortages.

How Does Inflation Impact Merchants?

The short answer is – it depends. Inflation affects businesses differently depending on multiple factors. You might find that your business is actually quite resistant to changing market conditions. For example, if you operate in a very competitive market, some of your competitors might be incentivized to keep prices steady and attract customers from other market players that need to raise their prices to stay in business. If your business is in a niche market with fewer alternatives for customers, you’ll have more liberty to raise your prices without fearing lost customers. In this case, your position in a niche market gives your business additional resilience to inflation.

Another consideration is the type of goods and services you sell. Customers will always cut back on non-essential or luxury goods first, so if you’re a jewelry store, inflation might give you a more challenging time than it would for a supermarket or grocery store. Economists call this the price elasticity of demand, which is a sophisticated way of describing how resistant something is to price increases. Price elasticity explains why people continue buying gas and bread even through exorbitant price increases but stop buying sweets and sports cars. If you sell products and services that people can’t live without, you’ll have an extra layer of protection during inflationary periods.

Looking at the market and the products or services you’re selling is crucial to understanding how your business will be impacted by inflation, but you should also examine your brand. A strong brand is an underreported strength of inflation-resistant companies, but it can play a key role in saving your bottom line. Customers often buy the brand behind the product and the odds of this happening increase with brand fondness. A study found that 73% of surveyed consumers will pay more for a brand they love and trust. If you have a strong and trustworthy brand that has loyal customers and advocates, chances are you’ll be better off than less established brands.

Even with these considerations, it’s impossible to shield yourself from high inflation completely. It will affect everybody to some degree. Building an inflation action plan for your business necessitates discovering the hidden ways inflation will impact your merchant account. Although not a comprehensive list, we’ve included below the most common avenues worth consideration by merchants.

1. Higher Credit Card Processing Fees

Visa and Mastercard suspended their plan to raise the interchange rate (also known as swipe fees) in 2020 to ease the burden of the pandemic on businesses. However, the card companies plan to continue with the rate hike in April 2022. This is a painful blow to many merchants and will exacerbate the effects of inflation on businesses across numerous industries. Swipe fees are designed to cover the costs of processing a credit card payment. They also offset the inherent risk of fraud in credit card transactions, with higher rates assigned to riskier transactions. Online purchases, for example, are notorious for their high swipe fees because the risk of fraud is much higher. If you operate an ecommerce store or your customers have a tendency to pay with cards, then this interchange rate hike will hurt you disproportionately more.

2. Your Customers Change How They Spend Their Money

This includes how much money they spend on your goods and services and how they pay you. Visa’s 2022 Back to Business Global Study noted that 41% of surveyed consumers said they plan to shift to using only digital payments within the next two years, or are already cashless. As the COVID-19 pandemic continues into its third year, customers are changing the way they make purchases, as well as how they pay. While trying to understand how inflation will affect your business, consider how your customers are paying you and if this will change. Additionally, as customers lose purchasing power and change their willingness to spend money, you could experience less demand for your products and services. You might need to address low sales volume and reduced revenue in the coming quarters, depending on what you’re selling and the characteristics of your customers.

3. Increased Operating Expenses

Rising prices can impact your bottom line in many ways, including general operating costs. Prices are steadily increasing for everything from food and office supplies, and this trend shows no signs of stopping. Costs from wages and employee benefits are also expected to increase over time from rising prices. Across the board, the Consumer Price Index (CPI) shows a 12-month percentage change of 8.5%. Although many prices are changing, energy is by far the most severely impacted category, with the CPI showing a 32% increase compared to last March. Energy inflation at this magnitude will heavily impact utilities, travel, and transportation expenses. However, merchants will also feel it throughout the supply chain as getting materials and goods from location A to location B becomes monumentally more costly.

4. Expensive Business Loans and Debt

When inflation rises rapidly, one tool the Federal Reserve has at its disposal is the federal funds rate. The federal funds rate determines how expensive it is for commercial banks to exchange their reserves with each other. Higher rates make it costlier for the banks to borrow from other banks, making it costlier for merchants to borrow money. When money changing hands becomes more expensive, it reduces demand and helps push back against inflation. Economists polled by Reuters expect half-point interest rate increases in May and June, which could see the rate at 1.50% by the summer. The economists also predicted that the Federal Reserve would continue increasing the federal funds rate until it reaches around 2.50%-2.75% by the end of 2023. Unfortunately, the positive effects on the economy from rate increases take a lot longer to kick in than the immediate adverse effects on merchants.

If your business recently took out a loan or is considering doing so in the near future, pay attention to lending restrictions and the details behind the loan. Fixed-rate loans won’t be affected by rate increases, but payments for variable-rate loans will become more expensive as the Fed raises rates. Additionally, if your business relies on maintaining a balance on your business credit card, your monthly interest payments will increase

How Can Merchants Protect Themselves From Inflation?

Just like how inflation affects every merchant differently, finding solutions for protecting yourself from these dangers involves just as much investigation. Your industry, customers, brand, and capacity for pivoting all influence how effective your inflation action plan is. Don’t know where to start? Below are some tactics we’ve used to help our merchants fight back against inflation. Keep reading to see if one or more of these are right for your business.

1. Implement Cash Discounts or Surcharges

Merchants looking to offset the expenses associated with credit card processing can implement a surcharge or cash discount program. These programs are great ways to recuperate swipe fees, as long as you minimize the impacts on customer experience. Surcharging adds a fee to the transaction if your customer pays with a credit card. This is a strong option if your business depends on competitive prices, as surcharging doesn’t affect the sticker price. Cash discounting reduces the price of your customer’s transactions if they pay with methods other than a credit card. This is a superior option to surcharging if a high-quality customer experience is more important than competitive pricing, as cash discounts don’t appear as fees on your customer’s sales receipt. Both programs have benefits and drawbacks, and choosing between the two, or foregoing them entirely, depends on your industry, customers, and local restrictions/regulations. Interested in setting up a surcharging or cash discounting program? Our team has set up and supported a variety of programs in numerous industries for our merchants. Connect with us today to learn more.

2. Prioritize Alternative Payment Methods

If credit card processing fees are compounding the effects of inflation on your business, but you’re hesitant to establish a surcharge or cash discount program, encouraging your customers to pay with alternative payment methods is a good solution. Examples of alternative payment methods include electronic checks and ACH payments, or prepaid cards like gift cards. Although cash and debit cards aren’t technically alternative payment methods, they still bypass swipe fees, so we’re treating them as alternative solutions, too.

What are the most popular forms of alternative payment methods? Recent research by PYMNTS found that cash was the most common alternative, followed by debit cards, PayPal, and digital wallets. The key is to make the payment process as frictionless as possible for customers. Another option to greatly reduce transaction costs is by accepting cryptocurrency. Although it may seem like a lofty goal for some merchants, we’ve developed proprietary software that makes accepting crypto pain-free and seamless for everyone – AdaptrPay. It’s a powerful tool that gives you complete control over your customer data and payment process, allowing you to make the best business-level decisions for yourself and your customers.

3. Increase Efficiency and Reduce Costs

Merchants can improve their bottom line by focusing on their internal processes to find opportunities for optimization or automation. Revisiting your payment integrations, hardware, and software suite are good places to start. Maybe you can find cheaper software alternatives than your existing solutions or make accepting payments more efficient. Additionally, if your ecommerce store is experiencing high rates of cart abandonment, revising your checkout flow could save your business just as much, if not more money than your efforts to reduce swipe fees.

4. Focus on Your Brand and Customer Experience

Reputable brands are more resilient to price increases, regardless of how the economy is doing. When Evolve Systems (our sister company) works with business owners on implementing a marketing plan, brand strength is always a key area of focus. It influences how customers perceive and interact with your business. Your customers with strong brand loyalty will be more receptive to unfavorable changes in their shopping experience, including price increases and surcharges. Being honest and transparent about price changes is important – inflation and a damaged supply chain affect everyone, and your customers could be surprisingly sympathetic. Implementing loyalty programs, opportunities for customer rewards, or revamping your store experience can also help provide value to your customers in ways that offset price increases

5. Reevaluate Your Merchant Processing Partnership

Your merchant processing partner should act as a shortcut for all your payment needs. They should be your advocates while also providing you with training and support if any questions or issues arise. This is especially pertinent during periods of heavy inflation when there’s a high degree of uncertainty. In anticipation of the large rate hikes and supply chain difficulties that disrupt the entire economy, an effective merchant processing partner will:

- Reevaluate your monthly statement to find optimization opportunities

- Renegotiate your existing rates or help facilitate a transfer to a different processor

- Improve your processes, hardware, software, and any integrations

- Provide training and educate you on the market pulse, especially regarding rates

- Continually offer support to you and your employees by being responsive in turbulent times

This dramatically reduces the amount of time and energy required by the merchant to stay ahead of inflationary pressures. By delegating merchant services to a trusted partner, you can focus on creating a solid customer experience and building the resilience of your business. If you don’t have a merchant processing partner, or your current partner can’t effectively support you during these tough times, reach out to our team and let us know. We’ll show you why having an effective merchant processing partner is a valuable addition to your business.