Evolve Payment Services, Industry Trends

From Paper Checks to FinTech: How to Streamline Your B2B Payments

Table of Contents

Accelerating Accounts Receivable With B2B Payments Technology

The days of cumbersome paper checks and out-of-PCI compliance snail-mail invoices are fading into the rearview mirror. An industry survey by the Association for Financial Professionals (AFP) found that check usage for business-to-business (B2B) payments declined to an all-time low of 33% in 2022. The gap between paper and digital payments continues to grow every year, and speed is the key driver behind this. Over half of all AFP survey respondents considered speed the most important factor when choosing a payment method. Over 60% of respondents reported that B2B transactions will benefit more from faster, real-time payments than any other evolution.

In today’s fast-paced B2B landscape, efficiency and agility are defining characteristics of a financially stable and healthy company, and streamlining your payment processes is no longer just optional–it’s essential for survival and growth. So, if you’re still clinging to archaic paper-based systems or even separate software that are not synchronized to eliminate dual reconciliation, it’s time to embrace the current times and evolve your payment processing solutions.

Benefits of Digital B2B Payment Methods

So, what does it mean to be in an evolved accounts receivable system? What are the tangible benefits of upgrading your payment infrastructure to a digital-first model over traditional B2B payment setups? More importantly, how do these benefits outweigh the costs of transitioning away from your old accounts receivable system, even if it’s been ingrained in your business for years?

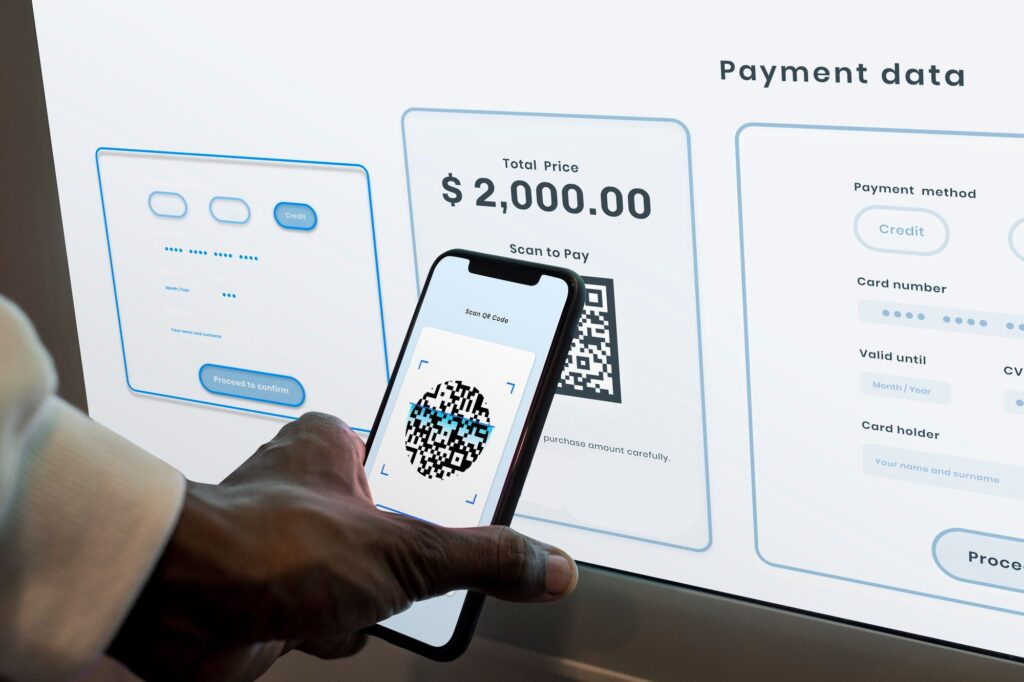

Faster Processing & Improved Cash Flow

Ditch the delays. An enhanced payment solution delivers instant or near-instant transactions, significantly improving your cash flow and boosting agility. The days of waiting to receive payments over the weekend are over.

Faster payment processing with digital payments, whether real-time payments or a different method, gives your business the edge over your competition. You’ll have more working capital from speeding up cash inflows. Shorter payment cycles with same-day funding and real-time payments allow you to be nimble and flexible in scaling your business.

Cheaper & More Efficient Than Paper

Paper checks involve printing, postage, and manual reconciliation, adding to substantial expenses. For example, the costs of processing a single business check can range from $4-$20. This considers the costs of check stock, stamps, envelopes, and resources spent writing, mailing, collecting, and reconciling payments.

Processing paper invoices incurs similar costs, especially for small and medium-sized businesses (SMBs). PYMNTS reports that one paper invoice costs SMBs $22 on average. A solution that works for you eliminates these burdens, slashing operational costs and boosting your bottom line.

Enhanced Security, Fraud, & Risk Safeguards

Paper checks are vulnerable to loss, theft, and fraud. AFP found that over 80% of B2B organizations reported being targets of an attempted or actual payment fraud attack in 2018 and 2019. This is 10% higher than in 2009 and 20% higher than in 2013-2014. With fraud on the rise, it’s paramount that your business doesn’t risk crucial cash inflows with paper payments.

Checks have an extended risk horizon, meaning multiple touchpoints are needed to process each payment. Each touchpoint, from manual handling to physical transportation and deposit, provides more opportunities for mistakes and fraud. Additionally, the lengthy clearance process leaves you at the mercy of bounces and payment disruptions with limited visibility and control.

Evolve Payment utilizes robust security protocols and white glove PCI/DSS assistance to safeguard your financial data and minimize risk. Digital payments are nearly instantaneous, leaving little room for error or any kind of fraud.

Improved Accuracy Through Automation

Manual error is a constant threat with paper checks. The extended risk horizon we discussed earlier increases the risk of not only fraud but also of more benign mishaps like mishandling, misplacing, or something else. A 2020 PAYMNTS study found that almost half of all businesses surveyed cited manual processes as one of the most critical friction points in their A/R processes.

Having a streamlined system that automates your accounts receivable, minimizes errors, and ensures smooth and accurate transactions allows you and your CFO to have peace of mind knowing that you have a partner in this process.

Better B2B Customer Experience

Faster payments, easier reconciliation, and enhanced security offer your clients a smoother and more positive experience. A study by U.S. Bank found that 47% of businesses want to bring P2P-style (peer-to-peer) payment systems into the B2B world to capitalize on the positive customer experience effects.

Your B2B clients will have less friction during the payment process, resulting in stronger partnerships and happier customers. The multitude of digital B2B payment options breaking into the industry gives your business plenty of options. Everything from P2P to credit cards for business transactions can give your customers’ accounting team peace of mind and one fewer headache during their day.

Bringing Digital B2B Payment Solutions Into Your Business

The journey to unshackling your current processor and A/R system doesn’t have to be daunting. With the increasing demand for seamless payment experiences, integrating digital B2B payment solutions into your business is a logical step forward. Not only will it enhance your relationships with your clients, but it will also streamline your payment processes, making life easier for everyone involved.

Transitioning to digital B2B payment solutions may initially seem overwhelming, but it doesn’t have to be. Many merchant service providers like Evolve Payment offer user-friendly software options that seamlessly integrate with your existing systems. Additionally, they provide comprehensive support and training to ensure a smooth transition for your business. Our team taps into our network of partners to find the right B2B payment platforms, gateways, and software for you. We’ll guide you through the process, offering practical tips and insight, including:

- Identifying your business needs and selecting effective and efficient solutions for the long-term, not just quick fix bandaids.

- Seamlessly integrating your new system to ensure no one gets left behind and your team feels confident using the technology that works for them.

- Communicating the change to your suppliers and customers while migrating your current customers’ tokenized data from one system to another.

- Qualifying your business for level 2 and level 3 payment processing by passing elevated data with every B2B payment greatly reduces your transaction fees.

Activate Your B2B Merchant Services

Embrace the revolution: By abandoning paper checks and embracing digital B2B payments with Evolve Payment, you’re not just changing how you pay; you’re transforming your entire B2B payment ecosystem. It’s a leap towards greater efficiency, improved visibility, and, ultimately, sustainable growth for your business.

So, ditch the dusty checkbooks and elevate your accounts receivable process. Your competitors are already there, and the future of B2B payments is digital.

So, are you ready to take the plunge?

Book a time to chat with Don, our merchant expert, and learn how Evolve Payment can elevate your accounts receivable process with a digital-first B2B payments system.